A well-structured trust is a central estate planning tool for small businesses and closely held family business owners when passing a business or wealth to your children. This includes heirs, beneficiaries, and future generations of your family and spouses while minimizing the impact of taxation and maximizing control. The state...

The Potential Tax Impact of Foreign Investments for U.S. Taxpayers

A common strategy many wealth management firms recommend is ensuring that as much as 30% of your portfolio includes foreign investments and securities. What is the potential tax impact of foreign investments? One of the keys to maximizing the advantages of offshore investment involves management of the effects of taxation...

The Next Chapter in the Beneficial Ownership Information (BOI) Report Process

The Supreme Court of the United States (SCOTUS) has written the next chapter in the Beneficial Ownership Information (BOI) Report process arising out of the Corporate Transparency Act (TCA). While the requirement to file the BOI and consequences for failure to do so remain suspended at this time, SCOTUS rendered...

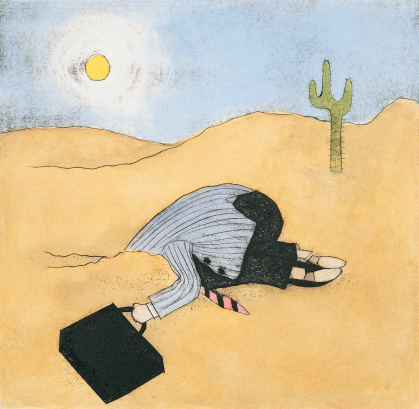

Important IRS and California Tax-Related Deadlines

Don't stick your head in the sand and miss important business or personal tax deadlines. Here are the important IRS and California tax-related deadlines for 2025: IRS and California Quarterly Estimated Tax Payment Due Dates for Tax Year 2025: Q4 Estimated Tax + Deferrals (2024) January 15, 2025 Q1 Estimated Tax...

A Foreign Trust Creates Complex IRS Reporting Requirements

The IRS has clearly identified legitimate reasons why "U.S. Persons" would establish or maintain ownership in a foreign trust. However, a foreign trust creates complex IRS reporting requirements for US taxpayers who own a foreign trust under the grantor trust rules, or are beneficiaries with an investment in a foreign...

Foreign Corporate Ownership and Investments

Are you involved in offshore or foreign corporate ownership and investments? Do you have real property, assets, or foreign bank or investment accounts? U.S. taxpayers with offshore business interests, holdings, investments, and bank accounts need an experienced U.S. international tax attorney as well as integrative business, legal, and accounting services. ...