How often should you review your trust and estate plan? Is there a regular cycle to these reviews, or should they be driven by significant events in your life or the lives of your beneficiaries and executor or trustee? How will the next few years in Congress impact trust and...

BOI Reporting Requirement Deadline is Now Set for March 21, 2025

Attention: FinCEN BOI reporting requirement deadline is now set for March 21, 2025. A decision yesterday, February 18, 2025, in the case of Smith, et al. v. U.S. Department of Treasury, et al., 6:24-cv-00336, has returned the reporting requirements of the Corporate Transparency Act (CTA) and the Beneficial Ownership Interest...

The Trend to Integrate Legal, Tax, Accounting, Business and Financial Advisory Services: the KPMG Arizona Gambit

It has always been prudent to search for firms who can integrate legal, tax, accounting and business advisory services. While there are few such genuine providers across the United States, firms like Allen Barron / Janathan L. Allen, APC do exist, and the KPMG Arizona gambit has legitimized the reasons...

International Business and Offshore Investment and Banking Create Genuine IRS Risk

International business and offshore investment and banking create genuine risk and exposure with the IRS. This extends to real estate ownership outside of the U.S. and other offshore-related financial activities, which raise red flags with the IRS. The past several years have brought rapid change in FATCA compliance, and the...

The Taxpayer Bill of Rights – 10 Essential Rights for U.S. Taxpayers

Are you aware of the Taxpayer Bill of Rights? We are reminded, especially during tax season, that taxpayers have 10 essential rights when dealing with the Internal Revenue Service. The IRS expects its employees to understand and apply taxpayer rights throughout the process of either an IRS audit or an...

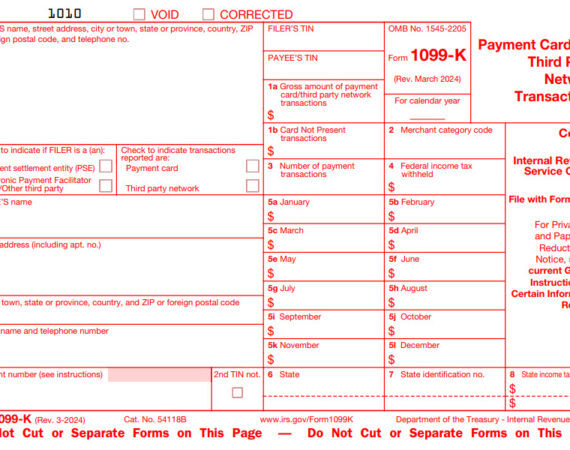

Will You Recognize the Form 1099-K When You Receive it This Year?

Will you recognize the Form 1099-K when you receive it from one or more third-party marketplace providers this year? A few years ago, the IRS implemented new reporting requirements for many popular peer-to-peer payment apps and providers, online marketplaces, ride-sharing platforms, platforms for craft or customized product producers, and even...

An Appeal of an IRS Audit is Based Upon the Audit’s Examination File

Did you know the appeal of an IRS audit is based upon the IRS examination file record of the audit itself? When the IRS produces its "Notice of Determination" at the end of an audit, a very important door closes: the ability to put information onto "the record" to bolster...