U.S. taxpayers with offshore investments should be wary of PFICs (Passive Foreign Investment Company). Many foreign nationals live and work in the United States. For those who invest in offshore companies that generate income in a passive nature (i.e. rents, royalties, interest, income from commodities or derivative trading) are permanent...

The New IRS Tax Bracket Changes for 2026

The cat is out of the proverbial bag as the new IRS tax bracket changes for 2026 have been published. The IRS has released the 2026 income tax brackets for U.S. taxpayers. How will this impact the tax picture of most Americans? Key Takeaways About the New IRS Tax Bracket...

Omissions, Fraud, or False Information on a Tax Return

What happens if you are accused by the IRS, the FTB, or another California tax agency regarding omissions, fraud, or false information on a tax return? The short answer is simple: failure to make a full, transparent, and honest disclosure, or fraud and false information associated with a tax return,...

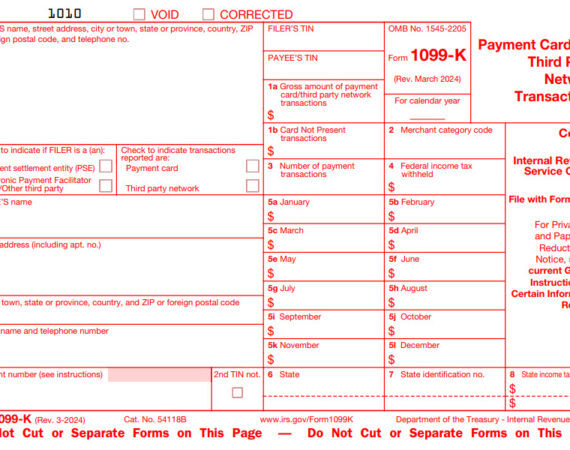

Will You Recognize the Form 1099-K When You Receive it This Year?

Will you recognize the Form 1099-K when you receive it from one or more third-party marketplace providers this year? A few years ago, the IRS implemented new reporting requirements for many popular peer-to-peer payment apps and providers, online marketplaces, ride-sharing platforms, platforms for craft or customized product producers, and even...

A Foreign Trust Creates Complex IRS Reporting Requirements

The IRS has clearly identified legitimate reasons why "U.S. Persons" would establish or maintain ownership in a foreign trust. However, a foreign trust creates complex IRS reporting requirements for US taxpayers who own a foreign trust under the grantor trust rules, or are beneficiaries with an investment in a foreign...

Internal Revenue Service Criminal Investigation (IRS-CI) Reports Billion Dollar Impact

Internal Revenue Service Criminal Investigation (IRS-CI) recently released its Fiscal Year 2024 (FY24) Annual Report, providing insight into the types of crimes the agency is focused upon, as well as the first criminal sentences in areas of focus. Of note, the IRS-CI confirms the first time a U.S. taxpayer has...

What is Willful Blindness According to the IRS?

What is willful blindness according to the IRS? How is this important in tax cases involving unreported or under-reported income, disclosure of offshore assets and income, FinCEN Form 114 (more commonly referred to as an "FBAR"), and even digital currencies and Non-Fungible Tokens (NFTs)? In an internal IRS memorandum from...

Those Above the Age of 50 Should Analyze Increased Tax Advantages of 401(k) Contributions in 2025

Are you above the age of 50? Do you and/or your spouse have a 401(k)? Are you interested in reducing the amount you will have to pay in 2025 income taxes while increasing the amount of money you receive after retirement? Those above the age of 50 should analyze increased...

Is it Too Late to Correct Past FBARs and File Amended Returns with the IRS?

Is it too late to correct past FBARs and file amended returns with the IRS? The net is closing in on U.S. taxpayers with unreported or under-reported domestic and offshore income and assets. The IRS has increased audits in this area based upon a significantly improved ability to process data...