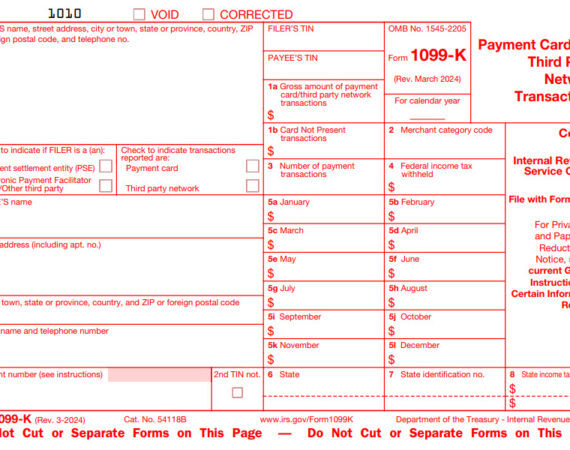

Will you recognize the Form 1099-K when you receive it from one or more third-party marketplace providers this year? A few years ago, the IRS implemented new reporting requirements for many popular peer-to-peer payment apps and providers, online marketplaces, ride-sharing platforms, platforms for craft or customized product producers, and even...

Selling items Online? Is the IRS Watching?

Are you selling items online or receiving payment for goods and/or services on platforms such as PayPal, Venmo, eBay, Zelle, Etsy, or Cash App? Online platforms are the preferred method of shopping for most Americans. These platforms also support the gig economy and, what has to date been, the potential...

IRS to Target Income from UBER, AIRBnB and other Sharing Income Sources

What would cause the IRS to target income from Uber, AIRBnB and other sharing forms of income? American University in Washington D. C. published a recent study that notes 2.5 million Americans earn income from Etsy, Uber, AIRBnB and other sources of "sharing" that presently go unreported. The IRS realizes...