Our offices have handled many cases of U.S. taxpayers, expatriates, and foreign nationals and spouses who live and work in the United States, with offshore accounts, assets, investments, business interests, or income. Many were not aware the U.S. taxes all income, worldwide. U.S. taxpayers are required by law to understand...

How to Deal with the IRS on Back Taxes

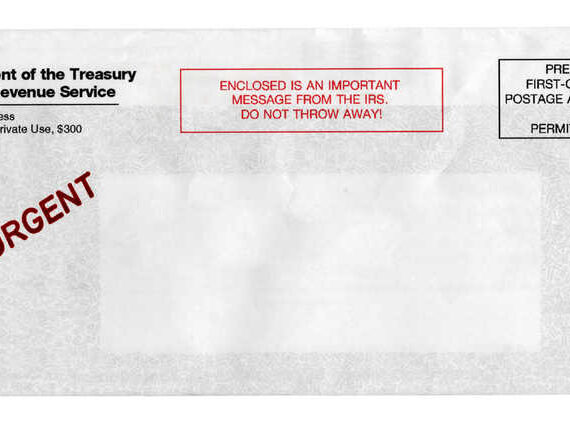

Are you concerned about how to deal with the IRS on back taxes? Have you received a communication from the IRS, such as a CP14 "Notice of Tax Due and Demand for Payment"? Take a breath, you have more options and time than your accelerating heartbeat would leave you to...

Why the IRS Requests Information During an Audit — and Why the “Why” Matters More Than the Request Itself

It is important for U.S. taxpayers to understand why the IRS requests information during an audit. If you have been contacted by the IRS or any state tax agency for additional information or an audit the "why" matters more than the request itself. Key Takeaways about Why the IRS Requests...

IRS is Considering Updates to the Voluntary Disclosure Practice

A request for public comment reveals the IRS is considering updates to the Voluntary Disclosure practice. The agency states its “commitment to improve its processes, and to further incentivize non-compliant taxpayers to come into compliance.” Key Takeaways Now That the IRS is Considering Updates to the Voluntary Disclosure Practice: The...

The IRS will Discover Your Offshore Financial and Digital Activities

As long as there have been taxes levied in the world, there have been those who try to work the system or evade taxes altogether. Unfortunately for many, the world has become a much smaller place for those who wish to underreport income or shelter their income and assets. The...

Why is a PFIC a Potentially Punitive Tax Consequence

What is a Passive Foreign Investment Company or PFIC, and why is a PFIC a potentially punitive tax consequence? Why is it important for any U.S. expatriate or U.S. taxpayer living or investing overseas to understand the concept of a PFIC and the implications these investments have on income tax...

IRS Continues to Tighten Focus on U.S. Cryptocurrency Investors

2025 has brought substantial new challenges as the IRS continues to tighten its focus on U.S. cryptocurrency investors. Cryptocurrency brokerages are required to report gross proceeds for each digital asset transaction they manage on IRS Form 1099-DA. This requirement applies to all digital currency transactions on or after January 1st...

How Might Marrying a Non-US Citizen Affect Your Taxes?

How might marrying a non-US citizen affect your taxes? What are some of the hidden issues that the IRS, California, and other state tax agencies may raise in an audit? Key Takeaways: The Ways in Which Marrying a Non-US Citizen Affect Your Taxes: The United States taxes the worldwide income...

Is the Burden of Proof on the IRS During an Audit?

Is the burden of proof on the IRS during an Audit? It might shock you to learn that the burden of proof in an IRS audit, and in most dealings with the IRS, lies with the U.S. taxpayer, not the IRS. Key Takeaways on Is the Burden of Proof on...