Are you searching for information on how to choose the right tax attorney? Are you a U.S. taxpayer who has a challenge with the IRS or a state tax agency? Are you facing an IRS or state tax audit? Are you an American expatriate or considering moving outside of the...

Serious Challenges for Expats and Those Considering Moving Abroad

The world is an ever-changing, ever-evolving crucible of financial and other serious challenges for expats and those considering moving abroad, as well as foreign nationals living and working in the United States. Oversight, tax exposure, and reporting requirements become more challenging each year. Financially speaking, the world in 2025 has...

The Taxpayer Bill of Rights – 10 Essential Rights for U.S. Taxpayers

Are you aware of the Taxpayer Bill of Rights? We are reminded, especially during tax season, that taxpayers have 10 essential rights when dealing with the Internal Revenue Service. The IRS expects its employees to understand and apply taxpayer rights throughout the process of either an IRS audit or an...

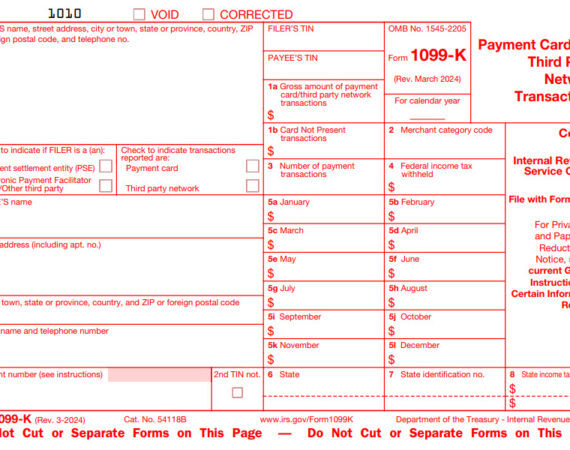

Will You Recognize the Form 1099-K When You Receive it This Year?

Will you recognize the Form 1099-K when you receive it from one or more third-party marketplace providers this year? A few years ago, the IRS implemented new reporting requirements for many popular peer-to-peer payment apps and providers, online marketplaces, ride-sharing platforms, platforms for craft or customized product producers, and even...

A Foreign Trust Creates Complex IRS Reporting Requirements

The IRS has clearly identified legitimate reasons why "U.S. Persons" would establish or maintain ownership in a foreign trust. However, a foreign trust creates complex IRS reporting requirements for US taxpayers who own a foreign trust under the grantor trust rules, or are beneficiaries with an investment in a foreign...

Foreign Corporate Ownership and Investments

Are you involved in offshore or foreign corporate ownership and investments? Do you have real property, assets, or foreign bank or investment accounts? U.S. taxpayers with offshore business interests, holdings, investments, and bank accounts need an experienced U.S. international tax attorney as well as integrative business, legal, and accounting services. ...

What is Willful Blindness According to the IRS?

What is willful blindness according to the IRS? How is this important in tax cases involving unreported or under-reported income, disclosure of offshore assets and income, FinCEN Form 114 (more commonly referred to as an "FBAR"), and even digital currencies and Non-Fungible Tokens (NFTs)? In an internal IRS memorandum from...

Is it Too Late to Correct Past FBARs and File Amended Returns with the IRS?

Is it too late to correct past FBARs and file amended returns with the IRS? The net is closing in on U.S. taxpayers with unreported or under-reported domestic and offshore income and assets. The IRS has increased audits in this area based upon a significantly improved ability to process data...

How Does the IRS Define Willfulness in Unreported or Under-reported Offshore Income?

How does the IRS define willfulness in unreported or under-reported offshore income? What actions help determine whether a U.S. taxpayer's actions amount to "willful or non-willful" conduct? Why should U.S. taxpayers be concerned whether the IRS perceives their actions as willful? If you have accounts with any Foreign Financial Institutions...