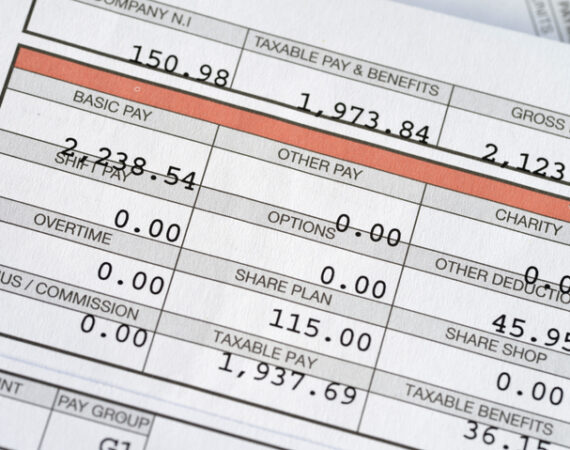

Many Americans have not noticed the paragraph above their signature line on the 1040 and other IRS and state tax forms, which notifies the taxpayer that they signed their tax return "under the penalties of perjury" and that they had examined the return and underlying schedules. The "Sign Here" block...

An IRS Audit Doesn’t Have to Be a Nightmare

An IRS audit doesn't have to be a nightmare of financial and emotional fear. How do most US taxpayers react when they receive an audit letter from the IRS? What are the actions you can take to not only improve the likelihood of the best possible outcome in an IRS...

Willful versus Non-Willful Conduct in the Eyes of the IRS

What constitutes willful versus non-willful conduct in the eyes of the IRS? Why is this distinction important to the agency, especially regarding international disclosures and taxable events? We are often asked about how seriously the IRS takes “willful” conduct into account as it applies to an audit or tax-related investigation. ...

ABCast Episode 2 – the Process of an IRS Audit

ABCast Episode 2 focuses on "the Process of an IRS Audit." San Diego tax attorney Janathan Allen discusses what a US taxpayer needs to understand about an IRS audit, their rights as a taxpayer and how to handle themselves. This podcast discusses what to do from the moment you receive...

The Primary Concerns and Considerations of an IRS Audit

What are the primary concerns and considerations of an IRS audit? What exactly is its fundamental and overriding purpose? Is it -- as an Internal Revenue Service communiqué recently stated -- "a deterrent to … potentially noncompliant taxpayers," or is it primarily and foremost a tool to generate much need...

Should You Amend Your IRS Tax Filing or Just Let it Go?

If you have found a mistake in a recent return should you amend your IRS tax filing or just let it go? Today is the dreaded extended deadline day for filing your taxes, and there may be some people out there who are realizing that they made a tiny, honest...

Should a Taxpayer Contact the IRS if They Receive an Audit Notification?

Should a taxpayer contact the IRS if they receive an audit notification? Quite simply - it isn't in your financial or legal interest to contact the IRS directly. Most citizens think that cooperating with the IRS is the best policy. They go out of their way to be courteous to...

Why Was Our Tax Return Selected for an IRS Audit?

We are often asked “Why was our tax return selected for an IRS audit?” If you have received a notification from the IRS of their intent to audit your tax return(s) your first step should be to gain an understanding of what to expect from an IRS audit. You should never...

Deductions That Often Trigger an IRS Audit

Are there red flags or deductions that often trigger an IRS audit? What are some of the known IRS audit triggers, and what should you be considering at this time? With the end of another year approaching, many of our clients are already considering tax preparation and planning for 2022. ...