The prudence of estate planning extends far beyond the question of “what happens to my money, assets, and belongings at the end of my life?” Estate planning facilitates shrewd planning and management of one’s life and resources, protects the interests and assets you’ve worked so hard to build, reduces the...

Substantial Recent Reduction in the IRS Workforce

What does the substantial recent reduction in the IRS mean for U.S. taxpayers and expatriates? How will staff reductions affect the agency’s ability to audit and collect taxes owed by U.S. taxpayers around the world? What impact will the newly confirmed IRS Commissioner have on the agency’s future? According to...

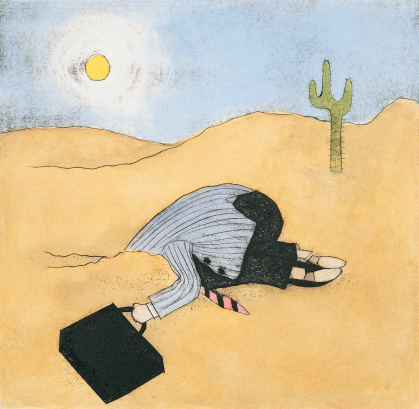

Important IRS and California Tax-Related Deadlines

Don't stick your head in the sand and miss important business or personal tax deadlines. Here are the important IRS and California tax-related deadlines for 2025: IRS and California Quarterly Estimated Tax Payment Due Dates for Tax Year 2025: Q4 Estimated Tax + Deferrals (2024) January 15, 2025 Q1 Estimated Tax...

Surprising IRS Tax Bracket Changes for 2025

Have you come across the surprising IRS tax bracket changes for 2025? Yesterday, the IRS released the 2025 income tax brackets for U.S. taxpayers. The inflation adjustments to tax brackets were a pandemic-boosted 7% for 2023 and 5.4% for this year's 2024 brackets. However, the annual increase in IRS tax...

New Corporate Tax Increase Proposal and Focused IRS Audits – Is the Cost of Business Going Up?

The Biden Administration’s new corporate tax increase proposal will face substantial challenges in both branches of Congress this year. The IRS continues to focus on the tax profiles of large corporations, limited partnerships and high-income individual US taxpayers. Is the cost of business going up? The administration recently proposed an...

The Importance of Establishing Corporate Compliance Guidelines (With Legal Help)

On behalf of Janathan L. Allen, APC posted in Management Advisory Services on Monday, June 11, 2012. There are plenty of reasons for businesses to seek legal help in San Diego, particularly during the process of establishing corporate compliance guidelines. Business lawyers can provide a number of services, whether your...

How Early Should Your Business Start Preparing Next Year’s Taxes?

On behalf of Janathan L. Allen, APC posted in Management Advisory Services on Thursday, June 14, 2012. Finding a reliable tax attorney can be difficult – there's no doubt about it. With the serious consequences that come along with tax errors, late filings and failures to file, however, it's important...

How Would the CA Governor’s Proposed Tax Hikes Affect You and/or Your Business?

On behalf of Janathan L. Allen, APC posted in Management Advisory Services on Thursday, June 7, 2012. Many California business owners are turning to corporate tax firms such as Allen Barron, Inc. to learn more about how the governor's proposed tax hike might affect them and their businesses, but many...

Four Potential Employee Benefit Issues and How Business Lawyers in San Diego Can Help

On behalf of Janathan L. Allen, APC posted in Management Advisory Services on Monday, June 18, 2012. There are many potential employee benefit issues that can arise as your business grows, which is one reason why business lawyers in San Diego are so vital to local businesses. Clients can count...