Are there red flags or deductions that often trigger an IRS audit? What are some of the known IRS audit triggers, and what should you be considering at this time? With the end of another year approaching, many of our clients are already considering tax preparation and planning for 2022. ...

What Most Californians Need to Understand about Tax Reform

While the actual tax code relating to the new tax reform bill is still be written there are some key takeaways most Californians need to understand about tax reform and specific deductions going forward. In a nutshell, be prepared to have less deductions and therefore ultimately pay a larger amount to...

How Does the Senate Tax Bill Affect San Diego Homeowners

How does the Senate tax bill affect San Diego homeowners and those considering purchasing a home in the future? The recent version of the tax reform package passed by the US Senate has local real estate industry representatives, developers and real estate agents quite concerned. This isn't over yet as...

Tax Planning for 2017 and 2018 is Now

The year is coming to a close and tax planning for 2017 and 2018 is in full swing. It's a good time to be considering the strategies which help you to lower your tax bill for 2017 and anticipate the best strategies to position you for the new year. Congress...

Would Trump’s Tax Plan Cost Californians?

Would Trump's tax plan cost Californians and raise our taxes? There are too many trial balloons and false starts coming out of Washington on the "tax" front, but we are monitoring these developments and advising clients as they navigate the complex issues facing today's business owners. The latest income tax...

Last Minute Tax Tips to Avoid IRS Audit Red Flags

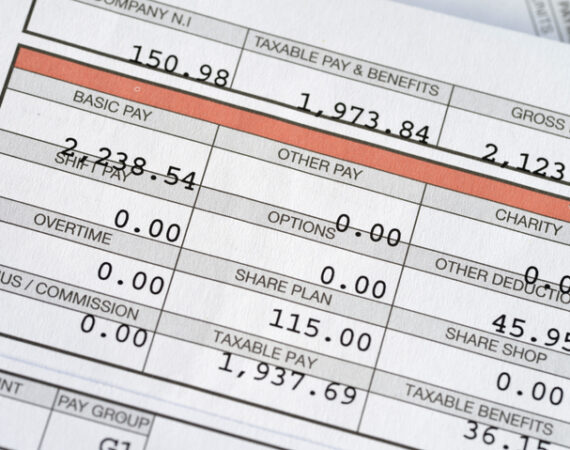

The deadline for filing your tax returns is quickly approaching on Monday, April 18th. Here are some last minute tax tips to avoid IRS audit red flags that create trouble down the road: Make sure your math is correct. This one appears to be obvious, but math errors deeply trouble...

If You Earn Over $100,000 Your Chances of an IRS Audit Significantly Increase

If you earn more than $100,000 your chances of an IRS audit significantly increase as income rises. While it is true that budgetary cutbacks have impacted the number of audits conducted, the IRS must still generate the same volume of revenue for the US Treasury. The IRS' solution: target high...

Additional IRS Audit Red Flags for Tax Return Season

It's tax season again, and the IRS has acknowledged additional IRS audit red flags to be cautious of on your 2016 tax return. Many of the IRS audit targets are not handled well by off-the-shelf "turbo" software solutions, so it is best to work with the tax preparation experts at...

When Does a Hobby Become a Business in the Eyes of the IRS

What is the difference between a hobby and a business from a tax perspective? When does a hobby become a business in the eyes of the IRS? If the IRS disputes your "business deductions" as a hobby it could trigger an IRS audit and result in a substantial payment to...