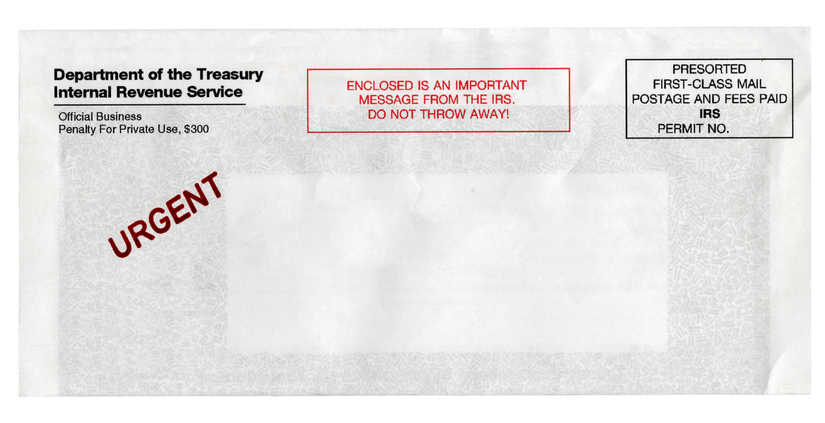

You need to be wary of what information the IRS requests for an audit and why. If you have received an IRS “Letter of Notification” informing you of an upcoming audit your first action to be to contact us at 866-631-3470. Dealing with the IRS is serious business, and the first communications with the IRS in response to the notification can be the most important. The IRS will request specific information as they begin to prepare for the audit. The real question isn’t “what” information the IRS requests, it’s “why” they are asking for information and the direction the audit will actually take.

The IRS respects a principled response from knowledgeable tax experts, and from the outset we are trying to establish to facts: the taxpayer is well organized and is operating from a financially sound and legally informed position of strength. If the IRS suspects that you are not organized, or that you have managed your taxes in an uninformed or cavalier way, you can be sure that the extent of the audit and the bill at the end will be much larger than it should be.

Are you concerned about what information the IRS requests for an audit and why? The “why” is the key to the audit. What is the IRS looking for? What triggered the audit in the first place? The information they request is often a set-up for where they actually intend to head during the audit. Our skilled tax attorneys understand the importance of engaging the IRS to gain a detailed understanding of the specific information being requested, as well as the reason for that request. Understanding these perspectives allows us to protect the interests of our client, and to keep the audit focused and as limited as possible.

IRS revenue agents have broad powers. They can seize any property they deem necessary and empty your bank and investment accounts. They can garnish your wages. All taxpayers are at a disadvantage when facing the IRS alone.

The purpose of the audit is not to simply double check your work, or to argue over a few dollars. Audit targets are generated because the IRS believes there is a substantial amount of taxes, penalties and interest that can be recovered from you.

You need to carefully think about what information the IRS requests for an audit and why. The ultimate purpose of an audit is to generate money for the US Treasury, and if you’ve received a Letter of Notification two thoughts should enter your mind:

- “The IRS expects and intends to recover a substantial amount of money from me”, and

- “I need to call Allen Barron immediately.”

This is serious business, and it won’t go away or resolve inexpensively. The least expensive and best course you can take is to work with a team of experienced tax professionals who will hold the IRS accountable to follow all applicable US an California laws. The return on investment (ROI) on any expense for representation in an audit is high, when compared to the amount you will pay if you face the IRS on your own. Keep more money in your accounts.

We invite you to contact us or call today to schedule a free consultation at 866-631-3470.