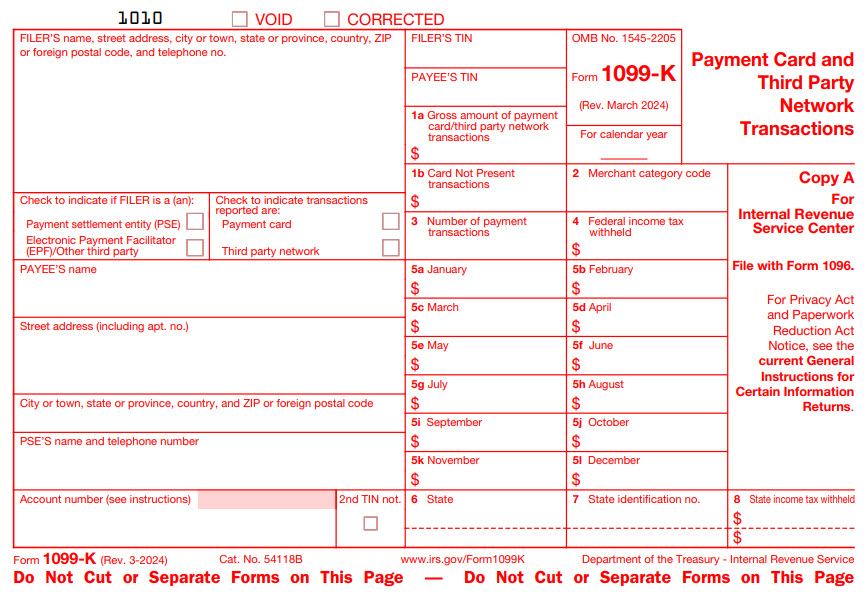

Will you recognize the Form 1099-K when you receive it from one or more third-party marketplace providers this year? A few years ago, the IRS implemented new reporting requirements for many popular peer-to-peer payment apps and providers, online marketplaces, ride-sharing platforms, platforms for craft or customized product producers, and even event ticketing and auction sites. Based on the American Rescue Plan Act of 2021, the new reporting requirements require these platforms to provide the taxpayer and the IRS with an IRS Form 1099-K – Payment Card and Third Party Network Transactions report.

The reason for this new reporting requirement was simple: to ensure businesses and individual U.S. taxpayers accurately reported all sources of income each year. Third-party payment and transaction platforms including, but not limited to, Paypal, Venmo, Cash App, eBay, Shopify, Etsy, GoFundMe, Kickstarter, Ticketmaster, StubHub, Uber, and Lyft are required to report total transactions for any business or individual that exceed $5,000 for 2024. Most of those who regularly conduct business on these platforms have been notified of the coming changes and reporting requirements for the past few years. However, the threshold for 1099-K reporting dropped to $5,000 for 2024.

Did you receive more than $5,000 in payment for any goods or services you sold or provided in 2024? If so, it is very likely the platform that managed payment for those transactions will provide you and the IRS with a full report of your earnings and activities. It doesn’t matter how many transactions you participated in. Will you recognize the Form 1099-K when you receive it and make sure to include it in the preparation of your income tax return(s)?

One online strategist recommended spreading transactions across platforms to remain under the reporting thresholds. This strategy simply doesn’t pass any review. Thresholds for the Form 1099-K continue to drop for 2025 and beyond. In 2025, these platforms must provide a Form 1099-K for those who exceed $2,500 in transactions or payments. In 2026 and beyond, the 1099-K reporting threshold drops to $600 per year, regardless of the number of transactions.

The lesson is simple: U.S. taxpayers are required to report all sources of income, domestic and international, to the IRS (as well as many states like New York and California, Colorado, Hawaii, Massachusetts, and South Carolina). The IRS will now receive the form 1099-K each year from required reporting platforms and simply need to ask their Artificial Intelligence programs to compare each 1099-K to the associated taxpayer(s). If you fail to include this form and report associated income, prepare for the proverbial “knock on the door” by the IRS and state tax agencies for an IRS audit or California tax audit.

For those who argue, “But I took a loss on some sales,” or even “I only sold one item for $5,000, but I purchased it for $5,800 and took a loss,” there is a line at the top of Schedule 1 that allows you to report your loss(es). This includes payments for items that are not the types of transactions, goods, or services required to be reported on Form 1099-K. This is also the location where the taxpayer may dispute incorrect reporting amounts.

Will you recognize the Form 1099-K when you receive it from one or more third-party marketplace providers this year? Are you prepared to ensure these amounts are reported on your business and personal income tax returns? Are you now aware that U.S. taxpayers are required to report income from the sale of services and goods, even if they did not receive a Form 1099-K? Ignorance of the law is not a valid excuse to the IRS or any state income tax agency.

We invite you to learn more about the integrated tax, legal, accounting and business consulting services of Allen Barron and contact us or call today to schedule a free consultation at 866-631-3470.