The cat is out of the proverbial bag as the new IRS tax bracket changes for 2026 have been published. The IRS has released the 2026 income tax brackets for U.S. taxpayers. How will this impact the tax picture of most Americans?

Key Takeaways About the New IRS Tax Bracket Changes for 2026:

- The Standard deduction for Single Filers and those filing separately is $16,100, an increase of $350 over 2025. The married filing jointly and surviving spouses’ income limit is $32,200, an increase of $700 over 2025. Head of household is up $525 to $24,150

- On Average, the tax bracket increase was the smallest in several years, at 2.7%; Last year’s increase (2025 brackets) was 2.8%.

- The Alternative Minimum Tax (AMT) exemption for next year will be $90,100 for single filers, and $140,200 for those who are married filing jointly. AMT is levied at either 26% for Alternative Minimum Taxable Income (AMTI) up to $244,500, or 28% for AMTI above the $244,500 threshold.

- Passage of the “One, Big, Beautiful Bill” has provided more than a few answers regarding original sunset risks associated with the TCJA. It is time to reassess and update your tax and estate planning.

2026 Changes in IRS Tax Brackets

Changes to income levels, brackets, and inflation adjustments to each tax bracket were the lowest in recent years at only 2.7%, compared to 2.8% last year, 5.4% in 2024, and 7% in 2023. How will this affect your tax planning for 2026?

Inflation is a key factor in the equation as the IRS sets our tax brackets each year. What is the relationship between the genuine increase in labor costs (and the resulting average income for U.S. taxpayers) and the financial impact of inflation? Many analysts believe the IRS works to balance the net buying power for each dollar earned against the cost of living and the effect of deductions and tax credits as it establishes these brackets. Inflation, most recently measured at 2.9% at the end of August 2025 (up from 2.7% in both June and July), remains relatively low, which may explain the lower percentage increase in the IRS’s income tax brackets for 2026.

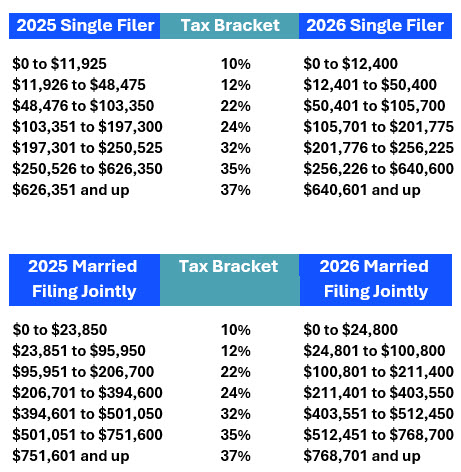

Here are the new IRS tax bracket changes for 2026 compared to the present rates for 2025:

What are the IRS Standard Deductions for 2025?

The standard deductions for 2026 will be $16,100 for a single tax filer (up from $15,000 in 2025), and $32,200 for those who are married filing jointly (up from $30,000 in 2025). Head of households will be able to claim a standard deduction of $24,150 in 2026.

Since the implementation of the Tax Cuts and Jobs Act (TCJA) in 2017, the vast majority (estimated to be near 90%) of U.S. taxpayers have taken the standard deduction instead of itemizing their deductions. This was originally scheduled to sunset at the end of 2025. It is important to note that this sunset in the increase of standard deductions was permanently eliminated by the “One, Big, Beautiful Bill Act” (Public Law 119-21).

The Alternative Minimum Tax (AMT) exemption for next year (2026) will be $90,100 for single filers, and $140,200 for those who are married filing jointly. AMT is levied at either 26% for Alternative Minimum Taxable Income (AMTI) up to $244,500, or 28% for AMTI above the $244,500 threshold

Looking Into the Future – How to Begin to Plan For 2026 and the Coming Years?

Finally, the new IRS tax bracket changes for 2026 and the passage of the “One Big Beautiful Bill” signify one positive for U.S taxpayers and families: tax planning and estate planning for the future has become much more stable, and long-term planning is much more reliable.

This is an excellent time to review any existing estate plans, trusts, business succession plans, tax planning, and transactional planning.

Our experienced estate planning and domestic and international tax planning attorney, Janathan L. Allen, describes transactional planning as “the development of an integrated plan that organizes corporate or individual assets (tangible or intangible), investments, real estate, or currency into a structure designed to protect these assets, mitigate risk, and minimize tax. This is accomplished through the strategic creation of entities that generate various types of income and losses, providing additional protections for those assets while controlling when (in which tax year) and where (geographically) income is realized. In essence, transactional planning involves structuring your entities and strategies to maximize the benefit of when you realize gains or losses, how you realize them, and where they are realized.”

While the new IRS tax bracket changes for 2026 may seem like a small gain for U.S. taxpayers, they are directly tied to the U.S. economy and inflation. 2025 and the passage of the “One, Big, Beautiful Bill” may prove to provide a more permanent structure and perspective from which to plan for the future. It is time for many U.S. taxpayers to evaluate their financial planning, estate plans, domestic and international tax planning, and the structure of their affairs as we look forward to 2026 and the foreseeable future.

Allen Barron, Inc. and Janathan L. Allen, APC provide integrated tax, legal, estate planning, accounting and outsourced accounting, and business advisory services to help our clients navigate these challenging times. It is important to schedule an appointment with Janathan Allen as soon as possible to discuss your unique situation, and how to plan, prepare for, and move forward after recent developments.

The past several years have been more than a bit of a wild ride. Now is the time to ‘reset your rudder’ and establish more concrete planning for the future.