Have you come across the surprising IRS tax bracket changes for 2025? Yesterday, the IRS released the 2025 income tax brackets for U.S. taxpayers. The inflation adjustments to tax brackets were a pandemic-boosted 7% for 2023 and 5.4% for this year’s 2024 brackets. However, the annual increase in IRS tax brackets for 2025 will be one of the smallest in recent history, reflecting only a 2.8% increase over 2024 income brackets. How will this affect your tax planning for 2025?

Inflation is a key factor in the equation as the IRS sets our tax brackets each year. What is the relationship between the genuine increase in labor costs (and the resulting average income for U.S. taxpayers) and the financial impact of inflation? Many analysts believe the IRS works to balance the net buying power for each dollar earned against the cost of living and the effect of deductions and tax credits as they establish these brackets. Inflation has returned to the lowest point since the pandemic, and that may explain the lower percentage of increase in the IRS’ income tax brackets for 2025.

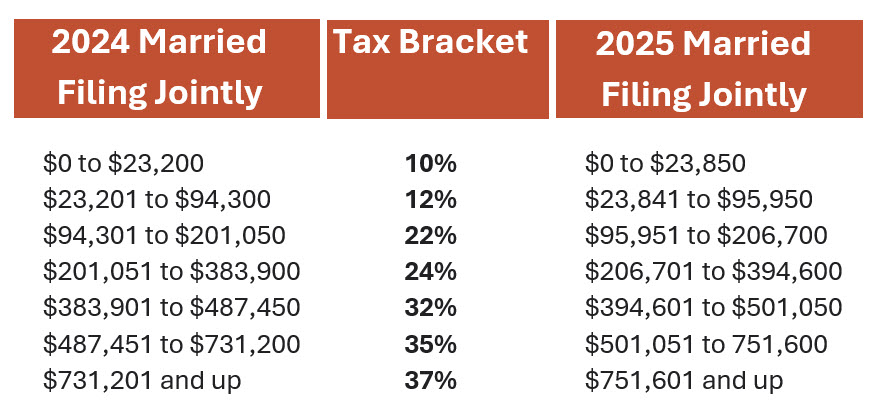

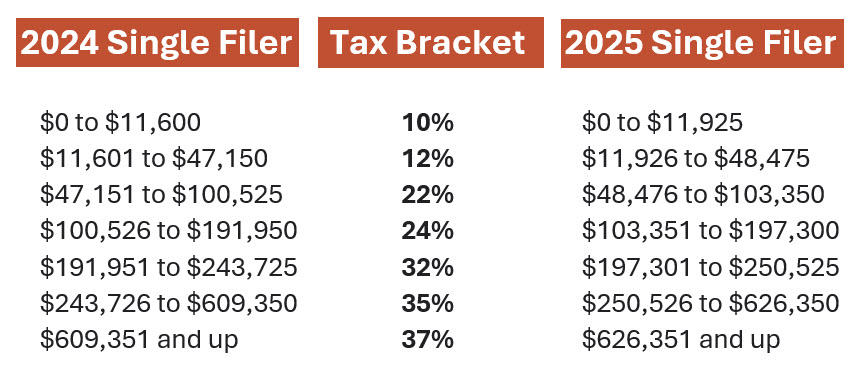

Here are the surprising IRS tax bracket changes for 2025 compared to the present rates for 2024:

What are the IRS Standard Deductions for 2025?

The standard deductions for 2025 will be $15,000 for a single tax filer (up from $14,600 in 2024), and $30,000 for those who are married filing jointly (up from $29,200 in 2024). Since the implementation of the Tax Cuts and Jobs Act (TCJA) in 2017, the vast majority of U.S. taxpayers have used the standard deduction instead of itemizing their deductions.

It is important to note that this increase in the standard deductions is scheduled to sunset at the end of 2025 and return to the pre-TCJA levels ($12,700 for those who were married filing jointly for the 2017 tax year).

Looking Into the Future – What to Plan For Beyond 2025

Finally, the surprising IRS tax bracket changes for 2025 fail to tell the real tax story for U.S. taxpayers as we plan for next year and beyond 2025. Many provisions of the TCJA are scheduled to sunset at the end of 2025. While elections are only a few weeks away, the new administration will not be seated until January 20, 2025. This means the U.S. Congress will have roughly 11 months to review the entire U.S. tax code as well as the impact of the sunsetting TCJA tax provisions.

If Congress fails to extend the TCJA cuts (or modify the U.S. tax code), Americans will face much higher net taxes for the tax year 2026. Not only will the tax brackets increase across the board, but the standard deduction most U.S. tax filers depend upon will be cut in half. What impact would a higher tax rate and fewer deductions have on your own taxable income? (Hint: it will substantially increase the amount you are required to pay in federal income taxes.)

Forewarned is forearmed

While the surprising IRS tax bracket changes for 2025 may seem to be lower than in previous years, these changes are directly tied to the U.S. economy and inflation. However, 2025 will be a watershed year from the perspective of the taxation of income in the United States. It is time for many U.S. taxpayers to evaluate their financial planning, estate plans, and the structure of their affairs as we approach the crucial new year of 2025, and the potential sunsets of crucial TCJA provisions.

Allen Barron, Inc. and Janathan L. Allen, APC provide integrated tax, legal, estate planning and accounting services to help our clients navigate these challenging times. It is important to schedule an appointment with Janathan Allen as soon as possible to discuss your unique situation as well as the impact of the potential sunset of TCJA provisions upon your financial, investment and tax strategies.

Forewarned is forearmed. 2025 promises to be an interesting if not a wild ride.

We invite you to learn more about the integrated tax, legal, accounting and business consulting services of Allen Barron and contact us or call today to schedule a free consultation at 866-631-3470.