It is important for U.S. taxpayers to understand why the IRS requests information during an audit. If you have been contacted by the IRS or any state tax agency for additional information or an audit the “why” matters more than the request itself.

Key Takeaways about Why the IRS Requests Information During an Audit:

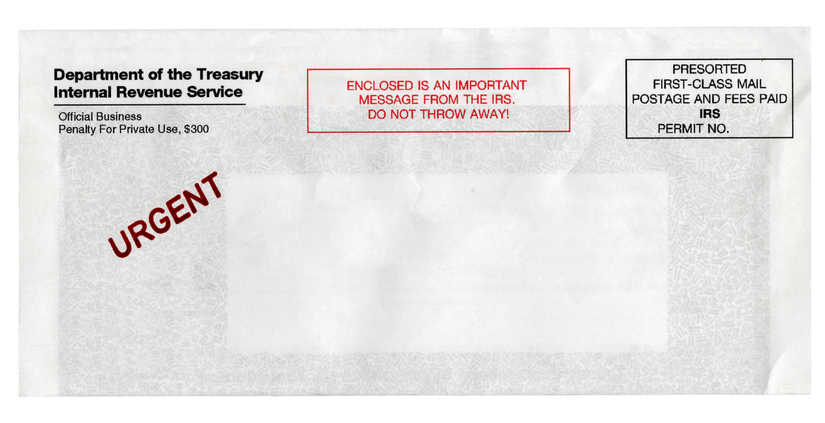

- If you have received an IRS Letter of Notification advising you that your return has been selected for audit, the most important thing to understand is this: the audit has already begun.

- Most taxpayers focus on what documents are being requested by the IRS, instead of why the IRS is asking for them, what risk the agency is evaluating, and where the audit is likely to head.

- The information requested at the beginning of an audit often serves as a roadmap. It reveals what triggered the audit and what the revenue agent is trying to prove.

- How the taxpayer responds to the requests of the IRS or state tax agency will determine the path of the audit, the likelihood of expense, and the size of the check the taxpayer will write at the audit’s conclusion.

- You should never speak with or provide information to the IRS or a State Tax Authority – It isn’t in your best legal or financial interests.

Have You Received a Communication from the IRS – The Investigation Has Already Begun

Have you received a communication from the IRS or any state tax agency requesting information? If so, an investigation has already begun. If you have received an IRS Letter of Notification advising you that your return has been selected for audit, the most important thing to understand is this: the audit has already begun. The first communications with the IRS often shape the entire direction, scope, and outcome of the examination.

You need to know why the IRS requests information during an audit or investigation. The IRS will request specific information as it prepares for the audit. Most taxpayers focus on what documents are being requested. That is a mistake. The more important questions are: why the IRS is asking for them, what risk the agency is evaluating, and where the audit is likely to head.

Those answers determine everything that follows.

An Audit is a Legal Process, not a Casual Review

An IRS audit is not a routine double-check or a negotiation over small discrepancies. Returns are selected because the IRS believes there is a meaningful likelihood of unreported tax, disallowed deductions, or misclassification of income or expenses. In other words, the agency believes there is enough money to be recovered from your pocket.

Every document request is tied to a specific legal purpose. The IRS uses those documents to verify accuracy, test compliance with statutory requirements, assess consistency across years, and evaluate whether issues reflect simple error, negligence, or something more serious.

How you respond — and what you volunteer beyond what is requested — directly affects how broadly the IRS proceeds.

The Real Risk: Signaling Disorganization or Weakness

From the outset, your experienced tax attorney Janathan Allen works to establish two critical facts with the IRS:

- The taxpayer is organized, documented, and compliant

- The taxpayer is operating from a legally informed position of strength

If the IRS senses disorganization, incomplete records, or casual handling of tax obligations, the audit almost always expands. Additional years may be opened. Additional issues may be examined. Penalties become more likely.

Audits rarely grow smaller on their own.

Why Understanding the IRS’s Intent Matters

Understanding why the IRS requests information during an audit or investigation and the intent of that request really matters. The information requested at the beginning of an audit often serves as a roadmap. It reveals what triggered the audit and what the revenue agent is trying to prove. Requests may be aimed at verifying income, testing deductions, reclassifying transactions, or establishing a factual record that supports penalties.

Knowing why information is requested allows your experienced tax attorney from Janathan L. Allen, APC to:

- Clarify the scope of the audit early

- Provide complete but controlled responses

- Prevent unnecessary expansion into unrelated issues

- Protect the client’s rights and financial position

This is not about obstruction. It is about precision.

The Power Imbalance is Real

IRS revenue agents are not advisors. They have broad statutory authority. They can levy bank accounts, garnish wages, and seize assets if liabilities are assessed and remain unresolved. While those actions do not happen overnight, the audit lays the foundation for them.

Taxpayers who face the IRS alone are always at a disadvantage — not because they are wrong, but because they are unfamiliar with how the system actually operates. You need to know why the IRS requests information during an audit or investigation, in order to protect your rights, interests, and money.

What Most Taxpayers Misunderstand About IRS and State Tax Agency Audits

Many taxpayers believe (or should we say “hope”) an investigation or audit is meant to “clear things up.” In reality, investigations and audits are revenue-driven enforcement actions. The IRS or state tax agency expects recovery. That recovery may come from additional tax, penalties, interest, or a combination of all three. They are coming for more of your money.

This does not mean the taxing authority is always right. It does mean the process must be handled deliberately, strategically, and with a full understanding of the legal standards involved.

The Right Response at the Right Time Matters

If you have received a Letter of Notification, two conclusions should be clear:

- The IRS believes there is a substantial amount of money at issue

- How you respond now will determine how expensive this becomes

Early, informed representation is almost always the least costly option. Properly handled, audits can be contained, resolved efficiently, and defended on the basis of the law and the facts. Mishandled, they tend to escalate.

Working with our experienced tax professionals who understand how the IRS builds cases — and how to limit them — is not an expense. It is risk management, and it will save you a substantial amount of money and time.

You Should Never Talk to or Provide Information to the IRS or a State Tax Authority – It Isn’t in Your Best Legal or Financial Interest

Did you know that as your tax attorney, Janathan Allen can and will handle all communications with the IRS or state tax agency? You never have to worry about how to respond, what information to provide, or how to best limit or eliminate your risks and exposure. You never have to speak with the IRS or any other tax authority yourself. This though alone should bring confidence and comfort.

Handled correctly, more of your money stays where it belongs: in your accounts, not the Treasury.

If you are concerned about why the IRS requests information during an audit, and why the “why” matters more than the information request itself, that concern is justified. The key is to address it correctly before the audit defines you, rather than the other way around.

We invite you to learn more about the integrated tax, legal, accounting and business consulting services of Allen Barron and contact us or call today to schedule a free consultation at 866-631-3470.