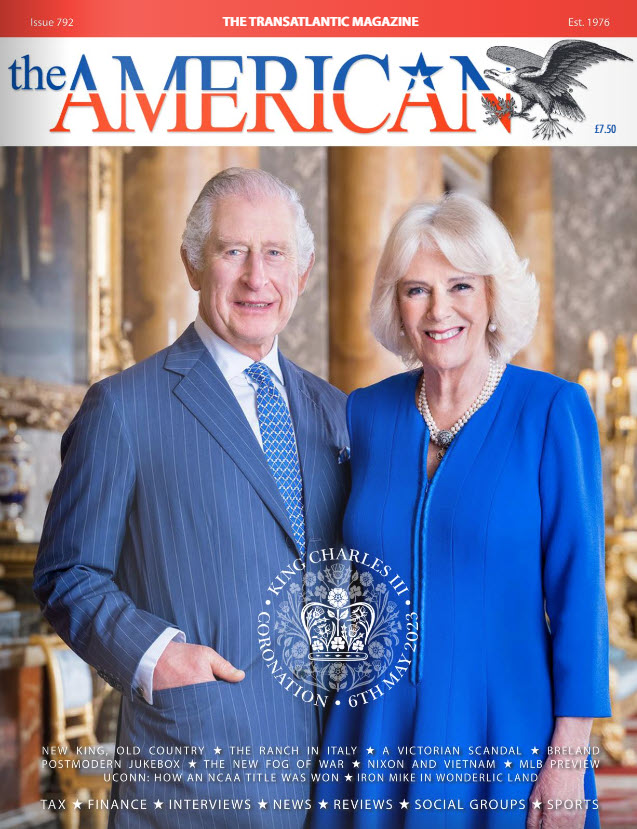

The American Magazine

The Advantage of Transactional Planning:

Real Life International Tax and Business Challenges

Janathan Allen Has been published in a recent edition of “The American,” a UK publication for US Expats.

International business and personal tax challenges are common for both US expatriates as well as US taxpayers with offshore investments, accounts, real estate and business interests. We thought you might benefit from a few real life international tax and business challenges as well as additional insight into the discipline of transactional planning.

Recently, a business person who was an American residing in Mexico was involved in transactions with one of our clients in Mexico, Central and South America. Unfortunately, this person passed away unexpectedly without a trust or will, no children and no living relatives.

Resources

My firm faced the task of closing down the business, reconstructing accounting, completing a variety of US and international tax returns and moving into an estate process even though there were no heirs or beneficiaries.

Our client, the business partner who had been funding him, had to wait more than two and half years to gain access to the accounts simply because there was no formal business relationship, trust or will.

Many of the challenges our (present) clients faced in the past involve missteps for US taxpayers associated with transactions outside of the US, and a failure to understand that even if a US taxpayer has moved everything about their life outside of the US, they are still required to file a US tax return as long as they are a US citizen.

The most common challenges occur because most people don’t know that the types of transactions and their structure, processes and protocols are completely different than how the same transaction is conducted in the United States. A simple example of that is a common investment and retirement vehicle in Europe – a foreign mutual fund.

Here in the US, when you purchase a mutual fund you receive a large packet with 1099s and a lot of computations at the end of each year. This includes dividends as well as capital losses and gains. You are taxed on any gain that has accrued in the mutual fund in the tax year in which the gain is realized.

Mutual funds in Europe are completely different. In Europe, a taxable event occurs when you withdraw funds or sell your interest in the mutual fund. There are no computations provided for your portfolio regarding dividends, losses or gains at the end of each tax year. Yet the US citizen is required to pay taxes based upon any gain in that foreign mutual fund. This results in a complex process known as a PFIC calculation (Passive Foreign Investment Company).

The PFIC process basically reconstructs what has happened in the offshore mutual fund in order to generate information for what would normally be provided on 1099s and the other computations. PFIC exposures are extremely costly, time consuming and complex resulting in a tax liability which most US taxpayers and expats were not expecting simply due to the nature of the investment they’ve made.

These are a few examples of why international tax planning and transactional planning are valuable. International tax planning must balance many often sophisticated and inter-related legal, tax and accounting issues to strategically position and structure the realization of income in the context of time and location (when and where) in order to legally minimize tax exposure.

Transactional planning is the development of an integrated plan which organizes corporate or individual assets (tangible or intangible), investments, real estate or currency into a structure designed to mitigate risk and minimize tax. This is accomplished through the strategic creation of entities generating various types of income and losses which allow us to provide additional protections for those assets, while controlling when and where income is realized.

A simple example of this would apply to anyone (US taxpayer or foreign citizen) who own real estate in the United States. The goal is risk mitigation and tax minimization. Placing the real estate into a Limited Liability Company or LLC separates the asset (now an entity) from the individual. If someone was injured on that property (think slip and fall) their only source of remedy would be the entity itself instead of the individual and all of their other assets, accounts and resources. Net result: asset protection/minimization of risk.

The strategic use of Passive Income Generators (PIGs) and Passive Income Losses (PALs) and other entities in this context provide the opportunity to legally reduce tax exposure. This is a fairly simple but straightforward example which helps to illustrate the greater concept of tax planning and transactional planning.

The United States is one of the only jurisdictions in the world which taxes income worldwide, regardless of when or where the income was realized. If you are a US taxpayer with international investments, assets, accounts or business interests or a US expat it is always in your financial and legal interest to work with an experienced professional who can integrate your legal, tax and accounting interests to develop an international tax plan as well as a transactional plan. Protect your assets and mitigate risk, while you minimize taxation and increase retained earnings.

Contact Us To Learn More About Allen Barron's Services

For more information or to discuss your tax, legal and accounting needs contact Allen Barron or call 866-631-3470 for a free and confidential initial consultation. Learn about the importance of integrated business strategy and coordination across legal, tax and accounting systems.

Offices of Allen Barron, Inc.

Main Office

16745 West Bernardo Drive, Suite 260

San Diego, CA 92127

Phone: 858-304-0947

Phone: 866-631-3470

Fax: 858-376-1410

San Diego Office

5720 Oberlin Drive

San Diego, CA 92121

Phone: 866-631-3470

Fax: 760-741-1410

Las Vegas Office

333 South Sixth Street, Suite 230

Las Vegas, NV 89101

Phone: 702-749-4430

Fax: 702-933-1748

San Diego Office

750 B Street, Suite 2610

San Diego, CA 92101

Phone: 619-702-8356

Fax: 619-923-8356

San Francisco Office

300 Montgomery Street, Suite 410

San Francisco, CA 94101

Phone: 415-481-0475

Fax: 415-762-1539

Phoenix Office

40 North Central Avenue

Phoenix, AZ 85004

Phone: 602-903-7018

Fax: 602-357-1655